Highlights

Key Investment Highlights

A snapshot of the key investment highlights associated with this EIS-eligible investment opportunity.

Strong

management team

Knowledgeable, ambitious and well-rounded management team. Highly experienced, qualified and respected in their fields.

Large market opportunity

There are 5.9m SMEs in the UK facing an estimated £22bn funding gap due to outdated and inefficient processes and customer journeys.

Established partnerships

Strong partnership engagement from major lenders, and Answer Digital and National Innovation Centre for Data (NICD) in place as technology partners.

Unique Technology

& IP

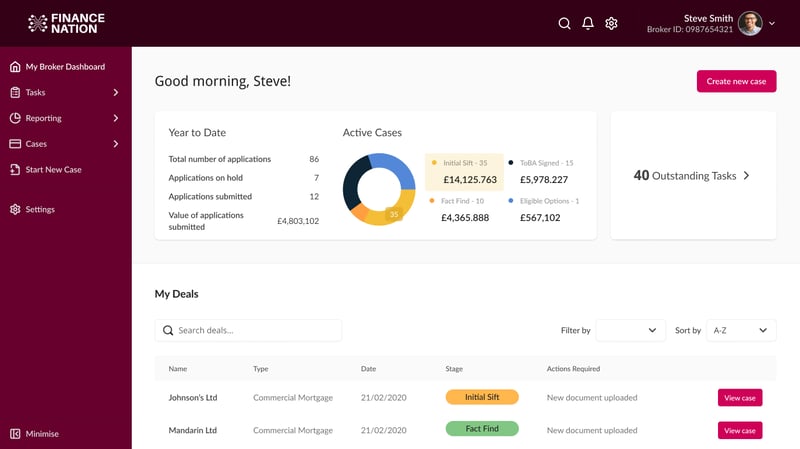

BFM utilises leading edge, cloud-based technology allowing it to re-engineer the customer lending journey, providing better customer outcomes and allowing for more effective use of a structured data lake.

Multiple

Revenue Streams

The BFM platform has five individual revenue streams. Only two have been modelled to date, providing significant upside potential.

EIS tax

reliefs available

Advanced assurance received. Investors have ability to access the generous tax reliefs available under the EIS, depending on individual tax circumstances.

%20(3)%20(2).jpg)