Venture Capital Explained

One of the UK's most popular asset classes, venture capital allows investors to contribute to some of the world's most innovative startups and scaleups whilst targeting considerable money-on-money returns.

Atom Bank

GCV portfolio company

What is Venture Capital?

Venture capital (VC) is the form of private equity concerned with investments into smaller, early stage companies. Involving investments into startups and scaleups at early stages of maturity, venture capital has the ability to generate considerable capital growth, but does involve some notable risks.

Below we provide an insight into the venture capital landscape for investors, exploring the varying stages of VC investors can access, the risks and rewards associated with the space and the typical investor profile venture capital can be suited to, before examining the most common routes investor can access it.

Please Note:

The value of investments and any income from them can fall and you may get back less than you invested. Please note that this article has been prepared as a general guide only and does not constitute tax or legal advice.

1. Introducing Venture Capital

An Increasingly Popular Asset Class

Venture capital (VC), the form of private equity involving investment into early stage companies, arose officially in the US in the 1970s when a shift in public policy fuelled it as a legitimate alternative form of small business finance to debt. Since then, VC has expanded exponentially.

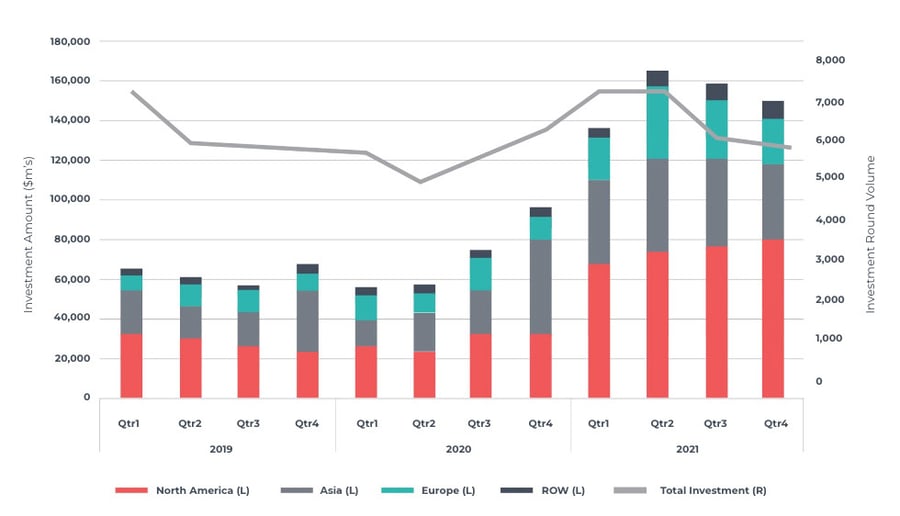

Today it is one of the most popular asset classes globally, and attracted a record $671 billion across 38,644 deals in 2021 (almost double the $347 billion the year prior).

Global Venture Capital Activity

Whilst a variety of routes exist for UK investors to mitigate the risks and maximise the potential returns associated with venture capital, thorough research into the asset class itself can be a crucial first step to consider before accessing any opportunity.

2. What are the Main Stages of VC?

Varying Levels of Maturity

Venture capital deals with investments into early stage companies, though a varying array of companies can exist within this criteria. Ranging in size, level of maturity and investment scheme applicability, these opportunities are often divided into three categories.

Pre-Seed Investments

This relates to the earliest stage of a company's development, whereby founders may still be developing their business plan. During this stage, founders may enlist the support of a venture builder to incubate startup development and secure investment. This tends to be the riskiest stage of venture capital investment, though has the potential to offer the most considerable investment growth.

During this stage the startup will be planning to launch its product or service. With no sales revenue likely being generated, seed stage businesses are likely to have a heavy reliance on venture capital. At this stage opportunities may be eligible for schemes such as the Seed Enterprise Investment Scheme (SEIS), which offers investors a range of additional tax incentives (including up to 50% income tax relief).

Early Stage investments

VC has a history of helping to build world-leading companies. Currently, eight of the ten biggest firms in the world by market capitalisation were built with the help of VC, including Apple, Microsoft and Amazon.

- Forbes

3. What are the Benefits of Investing in VC?

Considerable Returns, Tax Advantages

Exploring the advantages associated with venture capital can help investors to understand how the asset class is able contribute to their portfolio. Where opportunities can differ considerably from case-to-case, a number of core benefits are typically associated with VC.

Considerable Returns

Due to venture capital investments being made into companies at an early stage of maturity, this allows opportunities the potential to deliver considerable investment growth when compared with more mature private equity and listed equity options. Individual VC investments generally target between 5x-20x money-on-money returns, though some opportunities can target considerably higher.

Risk-Mitigating Tax Reliefs

In the UK, investors can make use of schemes such as the EIS and SEIS when investing in early stage companies to benefit from an additional range of tax incentives. Ranging from 30% income tax relief to capital gains tax exemption and inheritance tax exemption, these reliefs combine to help investors minimise the risk and maximise the potential returns associated with early stage investments.

The below table illustrates three potential outcomes of a £50,000 EIS-eligible investment for an additional rate taxpayer, in which the hypothetical company fails, breaks even and triples in value.

|

Company triples in value |

Company breaks even |

Company fails |

|

|

EIS investment |

£50,000 |

£50,000 |

£50,000 |

|

Income tax relief |

- £15,000 |

- £15,000 |

- £15,000 |

|

Net investment |

£35,000 |

£35,000 |

£35,000 |

|

Proceeds on disposal |

£150,000 |

£50,000 |

£0 |

|

Income tax loss relief |

- |

- |

- £15,750 |

|

CGT payable |

- |

Nil |

Nil |

|

Net profit/loss including income tax relief |

+ £165,000 |

+ £15,000 |

- £19,250 |

Portfolio Diversification

With early stage companies existing across a broad range of sectors and geographies, and each opportunity possessing its own level of target growth and exit plan, naturally, venture capital lends itself as a powerful portfolio diversifier for investors looking to achieve a calculated spread of risk across all of the above.

Alternative Investment Benefits

Categorised as an alternative investment (not falling under the traditional investment umbrella of listed equities, bonds and cash), venture capital is associated with the range of advantages typically linked to alternative assets. These include reduced correlation to market fluctuations and lower volatility to external fiscal events such as rapid inflation.

Positive Impact

Venture capital can provide individuals with the opportunity to invest in some of the world's most impact-driven startups and scaleups. Whether it is by backing the next energy-efficient housebuilder, medical manufacturer or SME lending platform, investors can balance generous target returns with positive environmental, social and governmental (ESG) impact within their portfolio.

4. What are the Risks of Investing in VC?

Balancing Risks and returns

Whilst posing a number of attractive investor benefits, venture capital is classified as a high-risk/high-return investment method. Subsequently, investors should weigh up the potential disadvantages associated with the asset class before investing.

Risk to Capital

VC investments are typically made into small, early stage, unquoted businesses, and whilst this can provide them with considerable growth potential, it can also make them more prone to failure. To minimise the chance of capital losses, investors can conduct thorough due diligence into providers, ensure their portfolio is adequately diversified and make use of tax efficient investment schemes.

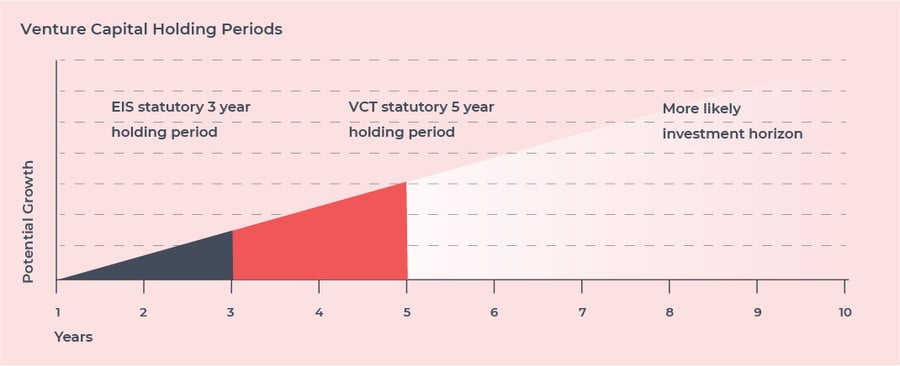

Lower Liquidity

Unlike traditional, listed equities that are able to be traded instantly on the stock market, venture capital is less liquid. This is partly due to VC schemes (such as the EIS, SEIS and VCTs) requiring minimum holding periods before tax relief can be claimed, but is ultimately due to early stage companies generally taking several years before they are able to reach an attractive exit event.

Less Transparency

Where the performance of public companies tends to be evaluated and publicised by industry analysts, this is not always the case with earlier stage companies. In turn, accessing venture capital opportunities through investment platforms that distribute regular investor updates on portfolio companies can be an effective route of ensuring maximum transparency into investment performance.

5. Who can Invest in VC?

A Range of Investor Profiles

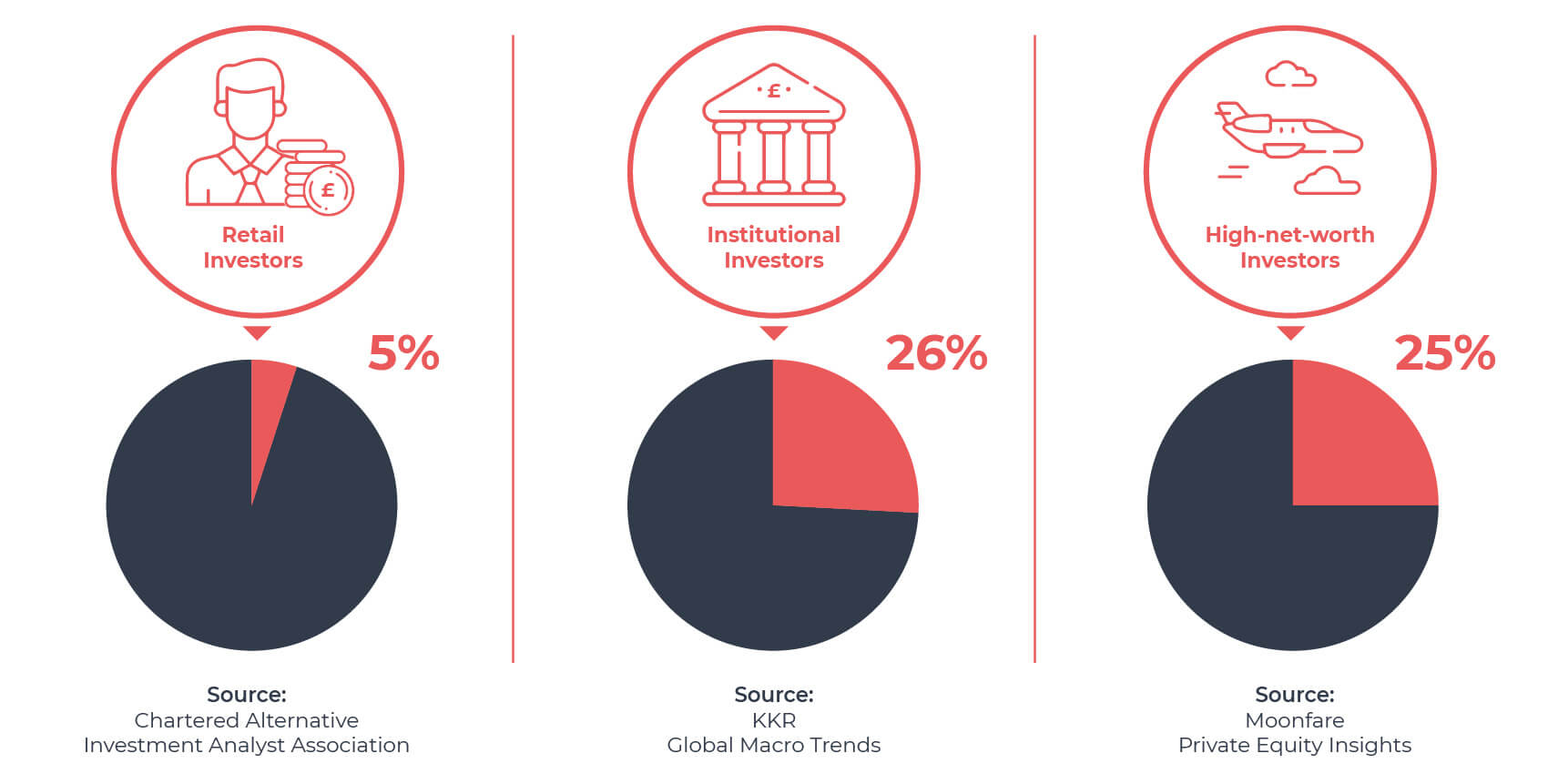

Where venture capital was once reserved strictly for institutional investors, today VC is one of the most popular asset classes among investors globally. Though various investor types can now access VC in some capacity, the asset class can be particularly attractive to three groups in particular.

Experienced Private Investors

With venture capital classified as a high-risk/high-return investment strategy, an adequate level of prior investment experience can be highly beneficial when selecting the most appropriate opportunity. Not only is an experienced investor is more likely to ensure the benefits of any relevant VC schemes are utilised, but that their portfolio is adequately diversified to maximise the impact of their investments.

High-Net-Worth Private Investors

With most high-net-worth investors (HNWI) accruing substantial annual tax liabilities, venture capital schemes such as the SEIS - that offer advantages including 50% income tax relief - can prove especially valuable. The comparably high money-on-money returns private equity often targets can also prove attractive for individuals with a higher level of disposable income (reflected in the figure below).

Institutional Investors

Institutional investors tend to allocate a significantly greater proportion of their portfolios to VC than retail investors, with the average institutional investor allocating 25% of their portfolio to private equity (VC's parent asset class). This is largely due to VC's ability to deliver superior long term returns - with institutional investors generally possessing a longer term vision and a higher tolerance for liquidity.

Private Equity Allocation Across Investor Type

6. How can I Invest in VC?

Three Varying Pathways

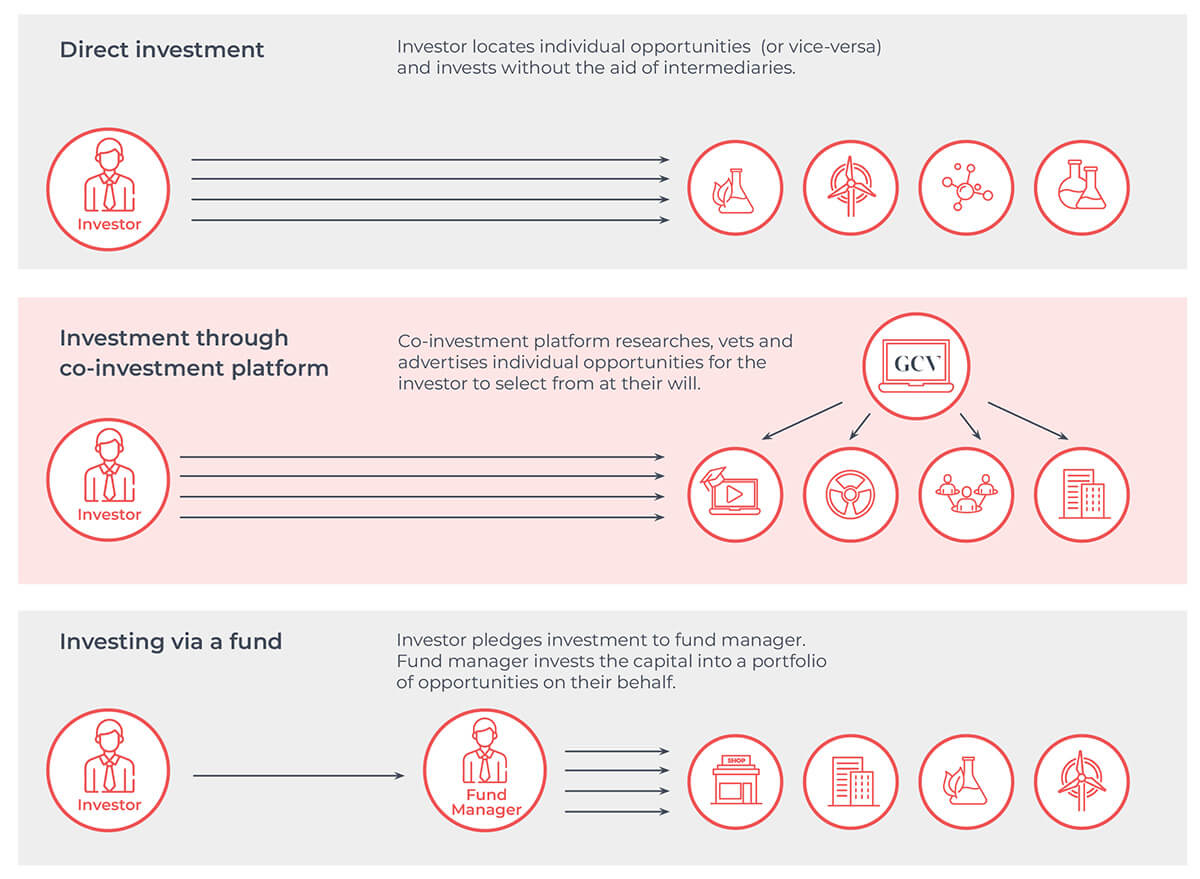

Venture capital opportunities can be accessed by investors via several routes, but most commonly fall under one of three categories.

Direct Investment

Direct venture capital investments occur when investors invest in an early stage company without the involvement of any intermediary. Whilst this offers the investor full autonomy over selection, it can carry higher risks due to a lack of participation from any other professional institution. For this reason, this route is most often followed by especially experienced with a strong background in a given sector.

Co-investment Platforms

Co-investment platforms compile a range of opportunities for investors to select from at their will, with reputable platforms researching, vetting and advertising companies to ensure they hit a strict eligibility criteria. Still offering full investor autonomy, co-investment platforms can mitigate some of the risk associated with investing in venture capital due to the input of a professional organisation.

Funds

Venture capital funds (commonly recognised in the form of venture capital trusts [VCTs]) pool investor capital to invest in a portfolio of companies. These companies are determined by a fund manager, who will usually charge additional fund fees. Though offering more effortless diversification, funds usually target less considerable growth than individual opportunities and allow less investor autonomy.

Venture Capital Guide

A Guide to Investing in Startups

In this guide, we offer a professional insight into the venture capital space and routes investors can make use of to access early stage investments, exploring:

- An insight into the history and current state of the startup investment landscape

- Why venture capital has proven to be ione of the UK's best-performing asset classes

- Routes investors can follow to minimise the risk and maximise the returns of their startup investments

- A first hand insight into the startup investment process using a portfolio company case study

Portfolio Diversification.

Superior Returns.

Become a GCV Invest Member

Venture capital investment opportunities with the potential to deliver superior returns.

GCV Invest is a private investor network and sophisticated co-investment platform, formed with the goal of connecting experienced investors with high-growth, impact driven alternatives investment opportunities, the majority of which reside under the asset class of venture capital.

Join our Private Investor Network.

Our Latest Opportunities

Venture Capital Investment Opportunities

Discover GCV's latest growth-focused, impact-driven venture capital investment opportunities, enhanced with tax efficient investment wrappers such as the EIS and SEIS where possible.

n-gage.io

| Sector: | SaaS |

|---|---|

| Target Sought: | £ 500,000 |

| Funds Raised: | £ 401,295 |

| Round: | Round 3 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

Growth Capital Ventures

| Sector: | Fintech |

|---|---|

| Target Sought: | £ 1,000,000 |

| Round: | Round 3 |

| Minimum Investment: | £ 5,000 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

Hive.Hr

| Sector: | HR Tech |

|---|---|

| Target Sought: | £ 150,000 |

| Funds Raised: | £ 303,000 |

| Round: | Round 1 |

| Investment Type: | Equity |

| Tax Schemes: | EIS, SEIS |

Intelligence Fusion

| Sector: | SaaS |

|---|---|

| Target Sought: | £ 400,000 |

| Funds Raised: | £ 556,800 |

| Round: | Round 1 |

| Investment Type: | Equity |

| Tax Schemes: | EIS, SEIS |

Hive.Hr

| Sector: | HR Tech |

|---|---|

| Target Sought: | £ 300,000 |

| Funds Raised: | £ 1,150,000 |

| Round: | Round 2 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

QikServe

| Sector: | Fintech |

|---|---|

| Target Sought: | £ 2,500,000 |

| Funds Raised: | £ 2,624,694 |

| Round: | Round 1 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

n-gage.io

| Sector: | SaaS |

|---|---|

| Target Sought: | £ 150,000 |

| Funds Raised: | £ 170,000 |

| Round: | Round 1 |

| Investment Type: | Equity |

| Tax Schemes: | EIS, SEIS |

Business Finance Market (trading as Finance Nation)

| Sector: | Fintech & Banking |

|---|---|

| Target Sought: | £ 150,000 |

| Funds Raised: | £ 225,000 |

| Round: | Round 1 |

| Investment Type: | Equity |

| Tax Schemes: | EIS, SEIS |

Growth Capital Ventures

| Sector: | Fintech |

|---|---|

| Target Sought: | £ 500,000 |

| Funds Raised: | £ 561,000 |

| Round: | Round 1 |

| Investment Type: | Equity |

| Tax Schemes: | EIS, SEIS |

Growth Capital Ventures

| Sector: | Fintech |

|---|---|

| Target Sought: | £ 1,000,000 |

| Funds Raised: | £ 1,290,410 |

| Round: | Round 2 |

| Investment Type: | Equity |

| Tax Schemes: | EIS, SEIS |

Cathedral Gates

| Sector: | Property |

|---|---|

| Target Sought: | £ 400,000 |

| Funds Raised: | £ 2,000,000 |

| Investment Type: | Equity & Debt |

Middleton Waters

| Sector: | Property |

|---|---|

| Target Sought: | £ 2,200,000 |

| Funds Raised: | £ 7,000,000 |

| Investment Type: | Equity & Debt |

The Langtons

| Sector: | Property |

|---|---|

| Target Sought: | £ 700,000 |

| Funds Raised: | £ 3,000,000 |

| Investment Type: | Equity & Debt |

Thorpe Paddocks

| Sector: | Property |

|---|---|

| Target Sought: | £ 1,000,000 |

| Funds Raised: | £ 6,000,000 |

| Investment Type: | Equity & Debt |

CoreHaus

| Sector: | Advanced Manufacturing |

|---|---|

| Target Sought: | £ 2,000,000 |

| Funds Raised: | £ 1,000,000 |

| Investment Type: | Equity |

Atom Bank

| Sector: | Fintech & Banking |

|---|---|

| Target Sought: | £ 1,000,000 |

| Funds Raised: | £ 1,100,000 |

| Round: | Round 1 |

| Investment Type: | Equity |

Business Finance Market (trading as Finance Nation)

| Sector: | Fintech & Banking |

|---|---|

| Target Sought: | £ 1,000,000 |

| Funds Raised: | £ 800,000 |

| Round: | Round 2 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

Finexos

| Sector: | Fintech & Banking |

|---|---|

| Target Sought: | £ 500,000 |

| Funds Raised: | £ 695,456 |

| Round: | Round 1 |

| Minimum Investment: | £ 500 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

Business Finance Market (trading as Finance Nation)

| Sector: | Fintech & Banking |

|---|---|

| Target Sought: | £ 250,000 |

| Funds Raised: | £ 278,855 |

| Round: | Round 3 |

| Minimum Investment: | £ 1,000 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

CoreHaus

| Sector: | Advanced Manufacturing |

|---|---|

| Target Sought: | £ 2,000,000 |

| Minimum Investment: | £ 5,000 |

| Investment Type: | Equity |

| Tax Schemes: | EIS |

Finexos

| Sector: | Fintech & Banking |

|---|---|

| Target Sought: | £ 500,000 |

| Funds Raised: | £ 680,462 |

| Round: | Round 2 |

| Investment Type: | Equity |

FAQs

Find out more about investing with GCV

Should you have any further questions regarding the venture capital investment opportunities we offer at GCV, and how to invest with us, you can contact our Investor Relations Team at any point - but we have provided a selection of frequently asked questions below.

-

The central investment hub and co-investment platform for the GCV private investor network, GCV Invest brings together a cohort of online and offline, private and institutional investors who all share one common mission - to access growth-focused, impact-driven alternative investment opportunities.

-

At GCV we only advertise a select number of venture capital opportunities on our co-investment platform every year. Though, as with any early stage opportunity, returns cannot be guaranteed, our experienced investment team employs rigorous due diligence and partnership processes to ensure portfolio companies are well-poised to deliver considerable growth as well as positive impact.

-

Targeting base-rate investor returns of 10x money-on-money (not guaranteed) at GCV we source VC opportunities that reside in a variety of sectors but that all share two defining features - high target growth and an impact-driven mission.

-

GCV Invest was launched to help experienced investors build a more diversified growth-focused investment portfolio.

The GCV Invest co-investment platform has been built for clients that meet the following criteria:

Is a Family Office, Institutional Investor, HNWI or Sophisticated Investor, seeking to invest alongside like-minded individuals and connect with the alternative investment ecosystem. Is looking to deploy over £10k in alternative investment opportunities per annum. -

You can sign up to the GCV Invest co-investment platform directly here, but if you have any further queries, or would like to register your interest first person with our Director of Investor Relations, Dan Smith, you can contact him via this email - dan.smth@growthcapitalventures.co.uk

-

We charge no upfront fees for being part of our investor network, having access to our opportunities or investing into our opportunities.

For investors, fees are only charged at the point of a liquidity event occurring (such as a trade sale or IPO). At this point, 7.5% of the investment gain is charged before funds are provided back to you as an investor.

Whilst dividend payments should not be expected from early stage investing, if and when they are paid, 7.5% of the dividend amount is charged to investors.

Have a query that you can't find an answer to? Please leave us a message via our Contact us page.

Latest Updates

From tax efficient investing to joint venture property investing, our blog is full of news, information and insights.

California's Living Desert Zoo & Gardens select UK tech firm n-gage.io

Chancellor’s “Mansion House Reforms” – how might they affect UK investors?

Subscribe

Let's keep in touch

To keep up to date on news, events and investment opportunities, sign up to our newsletter here.

* You can unsubscribe at any point using the link provided in the footer of all emails, for more information about how we handle data you can view our privacy policy.

%20(3)%20(2).jpg)