Tax efficient initiatives: from first home to IHT planning

The introduction of the Help-to-Buy Individual Savings Account (ISA) in December 2015 represented another example of financial assistance that was introduced to assist aspiring first time buyers.

Those that save through the scheme will benefit from a boost worth 25% of their savings when they purchase their first home.

The Help-to-Buy ISA is summarised alongside various other approaches to tax efficient investment in our free, downloadable guide.

Complementing the UK Government’s Help-to-Buy equity loan scheme, it enables buyers of new homes to buy with a 5% deposit and take out a mortgage of 75%.

The equity loan provides the residual 20% and is available interest free for the first five years.

Over 1,000,000 people have opened Help-to-Buy ISAs; evidence of the continued appeal of property ownership in the UK.

However, from 2019 Help-to-Buy ISAs will be incorporated with Lifetime ISAs (LISAs). The unification of deposit saving and retirement planning reinforces the sense that financial planning should adopt a ‘life-cycle’ approach.

From property purchase to estate planning

This extends to planning for retirement and, eventually, the transfer of your estate.

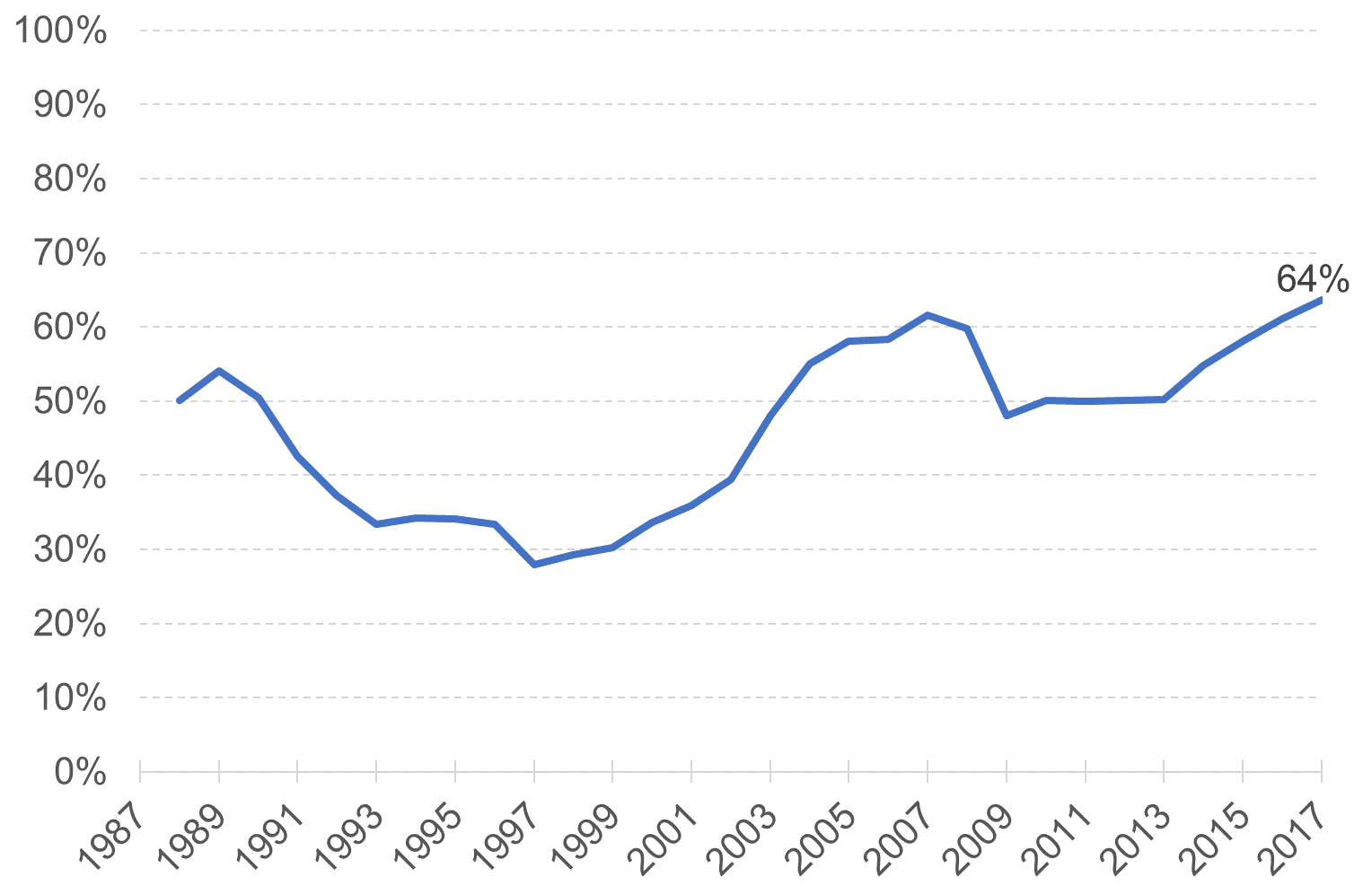

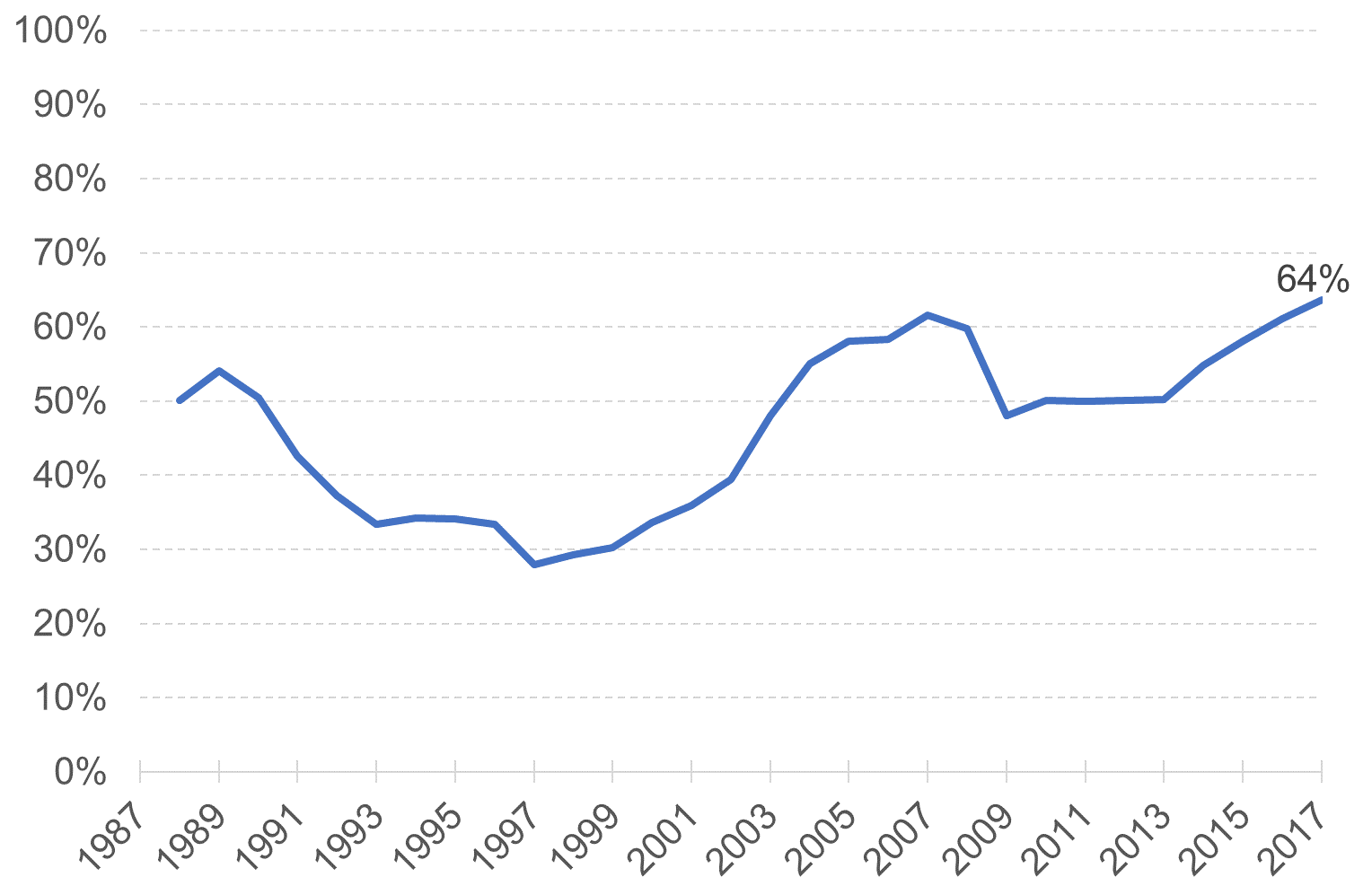

Whilst inheritance tax (IHT) may not be uppermost in the minds of people currently saving through a Help-to-Buy ISA, the chart below demonstrates the importance of estate planning for all property owners.

Change in average UK house prices, relative to the IHT nil-rate band

The chart presents average UK house prices since 1987 as a proportion of the individual IHT-free allowance, known as the nil-rate band.

This peaked at 64% in Q1 2017, having been as low as 27% in Q2 and Q3 1996.

This national average conceals higher property values in London and South East England.

The closer the average house price gets to consuming the nil-rate band, the more carefully estates will have to be planned.

The need for estate planning

Inheritance tax (IHT) is charged in the UK at a flat rate of 40%. This is the most straightforward aspect of IHT.

You will not be required to pay IHT on the entirety of your estate, but the proportion on which you will have to pay IHT will vary depending on a range of factors.

The prospect of having to relinquish 40% of the assets you’ve worked hard to acquire provides a clear incentive to arrange these in a way that minimises your IHT liability.

What's more, there are a variety of investment products that can help you achieve this, all of which are entirely legal and many of which offer benefits beyond minimising your IHT liability.

Tax efficient IHT planning

The good news is should your house value reach or exceed your nil-rate band, there are various means through which you can structure your other assets to minimise the IHT liability that they attract.

Fortunately, we’ve just produced a new, free guide to 'Mitigating IHT through Intelligent Investing'.

This guide provides you with an insight into how you can mitigate your IHT liability, giving a comprehensive understanding of how you can ensure your assets are enjoyed by the people closest to you.

By downloading the guide, you'll gain a free insight into:

- Who pays Inheritance Tax? – explores your likelihood of paying Inheritance Tax, looking at trends in the proportion of estates that are liable and the average liability faced.

- Understanding your Inheritance Tax liability – provides detailed information that will help you to understand what your IHT liability could be.

- Mitigating Inheritance Tax – introduces some of the most effective means by which to reduce your IHT liability.

Inheritance Tax may not seem like something you need to consider, either because you feel you're still too young for it to be a concern, and/or you won't exceed the current threshold.

But whether you take into account the average UK house price is currently £223,257 (immediately equating for over half of your Inheritance Tax liability), or that the more time you have to plan and prepare, the more likely it is you'll see additional benefits (investing in various EIS opportunities rather than just one, for instance), planning for IHT liability is something the vast majority of us should be making a consideration towards.

%20(3)%20(2).jpg)