Scaling up a business: the talent behind business growth

Scaling up an early stage business and raising capital can be daunting. The preparation and strategic overview that goes with this type of growth plan can take a considerable amount of time and planning.

One of the biggest factors considered when raising capital is to incorporate a strategic plan around recruitment and talent management.

When pitching to investors, they undoubtedly want to see the drivers behind the business; the people and the skills that are going to make that business a success and empower growth.

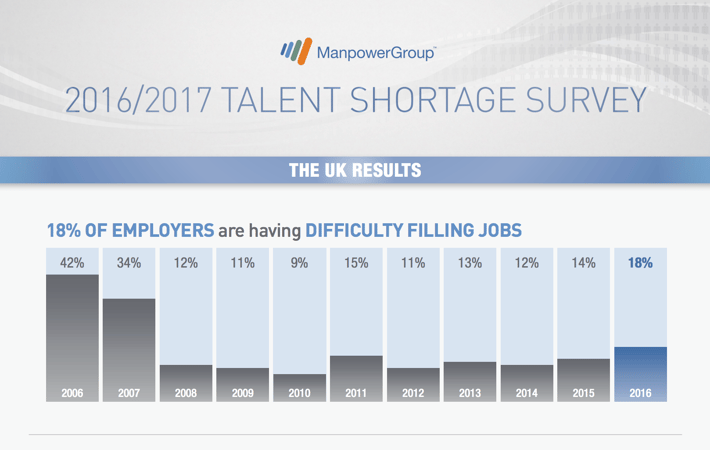

It's well documented that we're facing a talent shortage here in the UK, and it's been reported scale-ups create jobs at three times the rate those businesses in the FTSE 100 do. As such, this leaves them more exposed to increasing skills shortages.

What skills are important to business growth?

Finding a team that has sector experience can prove to be vital - but a mix of sector experience alongside professional experience is the ideal mix. An early stage business scaling up needs a team of people who can add value across many areas, ideally with an entrepreneurial approach to strive to make the business a success.

Defining the role to recruit is a hard decision

One of the toughest staffing issues when scaling up is knowing which roles to recruit for first. More often than not there are multiple options, which clearly presents a difficult decision - most companies, not just early stage businesses, don't have the luxury of hiring for every possible role in the business at once!

What's more, hiring the wrong roles can be expensive and time consuming, so prioritising growth and stability is a must.

I personally have a rule: if a possible new role cannot double their salary and overheads through billable projects or new clients, it's not generally viable to consider that role a crucial part of the growth plan at this stage.

Millennials bring a new set of skills

It's expected that by 2025, 75% of the global workforce will be made up by millenials. As such, a new set of skills and characteristics - essential to future-proofing any business - are being introduced. For this reason, Millennials are key to unlocking growth through technical innovation and knowledge.

Attracting this talent is clearly crucial. However, with this new set of skills comes a level of expectation that doesn’t always fit with traditional employee incentive structures. While millennials bring new skills and a fresh perspective, the experience and wisdom of the older generation is essential to building the foundations needed to scale-up securely.

A business that can attract both generations - and succeed in uniting that workforce under a shared corporate vision and purpose - will go a long way to equipping itself with the talent and skills it needs to thrive.

But how do we retain those teams needed to grow the business?

Retaining and developing a skilled workforce is fundamental to the success and growth of any business, but more so an early stage business.

Talent management focuses on an employer’s commitment to recruit, retain and develop those employees showcasing their talent and potential. It’s about selecting the right people and developing their potential and fuelling their enthusiasm, passion and ability, thus building their commitment to your organisation.

Engaging your workforce is a key process - recognising how a more engaged and focused workforce increases their value to the company when their skills, knowledge and creativity is being applied more effectively. It allows people to practice what they do better, and software can help assess how engaged your workforce are.

A prime example is Hive.HR, a company who have raised capital seed stage funding through GrowthFunders. They have changed the way employee engagement is assessed, as the product is built to send out a short, weekly survey, replacing the traditional yearly survey that becomes outdated very quickly.

Businesses aim to give more attention and action to both of these areas. However, it’s about how well these areas are developed and maintained, too.

Take time, plan wisely and encompass your strategic aims

Get the very best people, who fit with the vision and culture of the company, then invest in the very best training you can afford. As a business owner, you’ve also got to be self-aware enough to know your limits and recognise when it’s time to bring in people with more expertise than yourself.

Business Rule No 1 is people are key to how successful your business becomes. Set your goals, then work out who and what is needed to achieve them.

Recruiting doesn't need to be overwhelming. In a nutshell, it's about planning and dedicating time and finance to ensure your key hires are the right people for your business.

Get this right, and you'll be doing a lot to pave way for your future successes.

%20(3)%20(2).jpg)