Co-investment collaboration: Crowd & Venture Capital

GrowthFunders are pleased to announce the collaboration of our first investment opportunity with the market leading crowdfunding platform, Crowdcube.

Having attracted anchor investment through the GrowthFunders platform from Finance Durham (managed by Maven Capital Partners), Intelligence Fusion will now be offered to retail investors through the Crowdcube platform.

This collaboration will boost exposure for Intelligence Fusion significantly, not just for the purpose of the investment opportunity but additionally for the general awareness of the platform and service.

About Intelligence Fusion

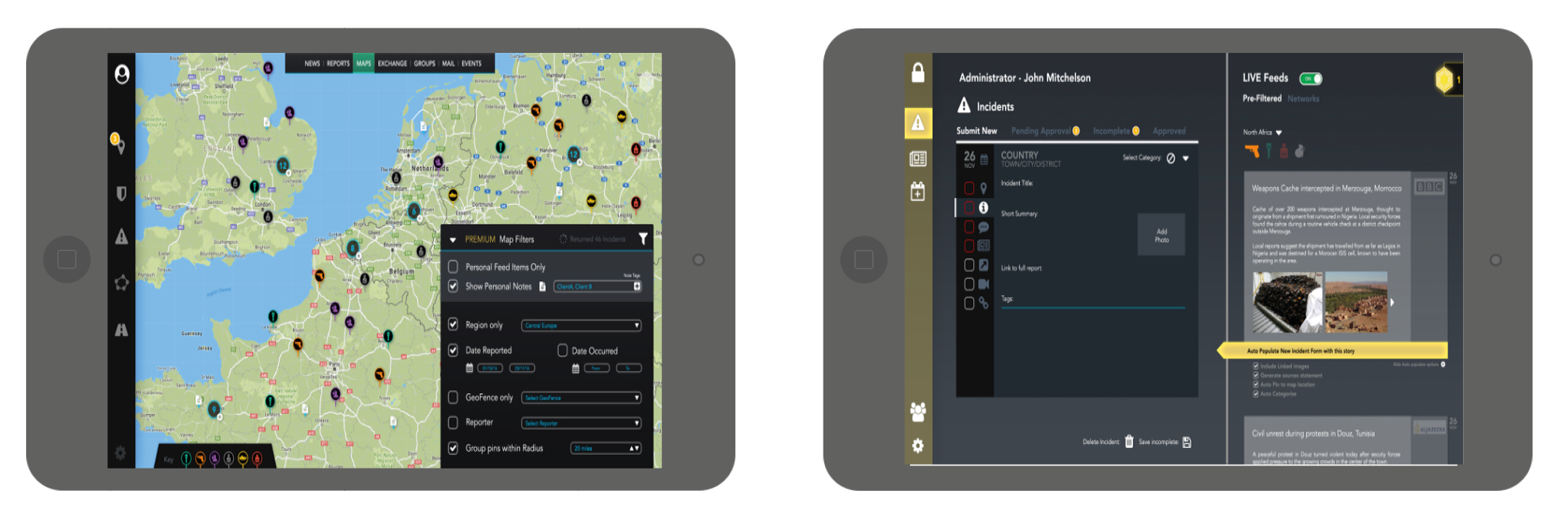

The Durham-based business, which was set up in 2015, provides a platform to help security companies and global businesses manage risk and security issues by collecting, analysing and disseminating intelligence.

After successfully raising funds for their proof of concept round through GrowthFunders, Intelligence Fusion is now raising capital to enhance its platform with more features to provide global coverage at greater speed, frequency and quality.

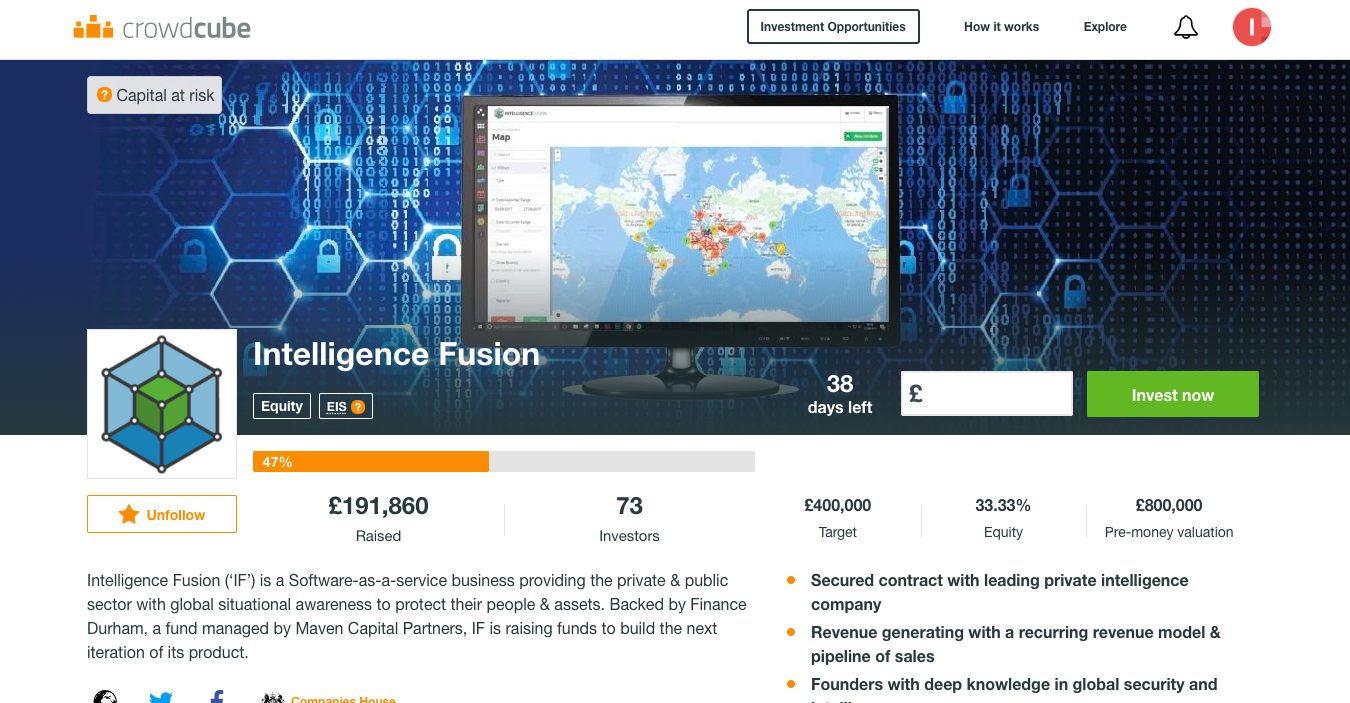

Looking to raise total of £400,000 growth capital, Intelligence Fusion ran an online campaign through the GrowthFunders platform to attract professional investors while meeting with Institutional Investors to ensure the round was anchored by the most suitable partner.

The online campaign attracted a quantum of £166,400; £66,400 from the G Ventures Network of Professional Investors and a £100,000 anchor investment from the Finance Durham Fund to develop its online global intelligence and risk management system.

Additionally, the campaign attracted investment that placed the campaign into overfunding. However, once the online campaign was concluded and we moved to financial close, the additional investment was unfortunately unable to be completed within the required timescales.

Through the collaboration, we're now excited to be providing the opportunity to Crowdcube's investor base.

With Intelligence Fusion planning to become a global intelligence leader in five years with annual revenues of circa £5.5m, the company has already had an acquisition approach from a US intelligence company.

Having clients including private security companies, banks and government agencies to name but a few, one of the world’s largest private intelligence companies currently has an exclusive subscription to the Intelligence Fusion platform so they can integrate the data into their existing platform.

Moreover, one company that pays to access Intelligence Fusion is currently protecting one of the largest movie franchises filming globally.

Intelligence Fusion also cites a three star NATO general who, in July 2016, said of its reporting “I just wanted to let you know I look for your Fusion updates every day! Your straight-forward presentation and solid analysis is most helpful; I am impressed by the product timeliness as well.”

Who are Crowdcube?

Crowdcube are a well known equity crowdfunding platform with access to some of the most experienced investors in the UK.

Their crowdfunding platform, alongside our co-investment platform, will strengthen the offering for the entrepreneur and investor alike.

The Intelligence Fusion pitch is now live on the platform and Crowdcube are delighted to be collaborating with GrowthFunders, opening this opportunity to their network of investors.

This is an exciting new relationship and we are delighted to be able to share Intelligence Fusion with Crowdcube's investors as the first collaboration and look forward to a successful example of co-investment across all networks.

What is co-investment?

Co-investment is the investment into an equity funding round where the funds come from several sources including institutions, angel investors, high-net worth individuals and retail investors.

Our co-investment model is one which brings together different types of investors into the same round or deal on identical terms.

This means institutional money that requires ‘matched funding’ can be enabled on the platform whilst opening up some of the more thoroughly prepared investment opportunities to sophisticated investors and high net worth individuals.

Once this has been carried out and the round has been ‘anchored’ it can then be opened up to the ‘crowd’ via channels such as Crowdcube. This lets everyday retail investors buy shares into some of the most innovative high-growth SMEs in the startup market.

As detailed above, as a co-investment platform our approach is to work with professional funds to anchor the round and co-invest with suitably qualified retail investors.

In this spirit, we are delighted to be taking this investment opportunity forward and collaborating with one of the UK’s leading private equity platforms, Crowdcube.

Campaign plans

As this campaign is taking a collaborative approach, Crowdcube will be promoting Intelligence Fusion alongside ourselves in striving towards the total funding goal of £400,000.

This will expose the opportunity to not only the GCV and GrowthFunders network, but the extensive Crowdcube network of investors.

This exposure at this stage of the business will set Intelligence Fusion up with a vast array of advocates and business angels who will work together to take the company to their next stage of growth.

As a global, scalable software business, Intelligence Fusion are aiming to become the leading situational awareness platform within five years - enabling companies and individuals to better protect their people and assets.

To view the Intelligence Fusion opportunity on Crowdcube, click here.

%20(3)%20(2).jpg)