So you think your start up has no competition?

One of the most oft-heard phrases for us from entrepreneurs and businesses owners is: "my business doesn't have any competition".

Perhaps you've found yourself thinking the same thing when looking at your startup or early stage business.

You've done some market research and Googled all manner of key words and phrases related to the service or product your business provides but the search has come back with zero results.

In fact, you came up with the idea yourself and patented the innovation. Therefore, you know for a fact that you have no competitors.

Unfortunately, that's not the case and those few words can prove to be the killer phrase in terms of putting potential investors off investing into your business at all.

No matter how innovative and unique your idea may appear to be, nine times out of ten, there will be something similar already on the market. You may just have to look a bit deeper and think a bit more outside the box, that's all.

If potential investors hear you don't have any competitors they may simply believe that you haven't carried out sufficient market research. All this means is that you don't have a direct competitor; there are other types of competition that your business most likely will have, which is what we'll take a look at in this post.

In an article in The Guardian, angel investor, successful entrepreneur, and former "Dragon", James Caan said:

Whilst James is right that it's impossible not to have competitors, direct and indirect aren't the only forms you could be facing.

Types of competition

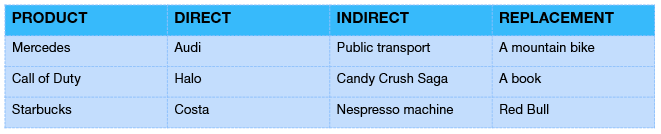

When it comes to finding your competition, try not to think too narrowly. Dismissing startups and more established businesses because they initially appear too different to yours means that you could overlook some close substitutes which are providing good or better solutions to the same target market as your product or service.

- Direct

- Indirect

- Replacement

We'll look at what each of the above types mean and then follow with some examples.

Direct

Usually what people think of when they hear "competitor". A direct competitor is a business that essentially offers the same product or service as you do.

Indirect

An indirect competitor is a business which offers a similar product or service but may be in a different sector of the same market.

Often more difficult than direct and indirect competition to uncover is...

Replacement

A substitute for the product or service offered by your business. They do not need to be in the same sector and will not be immediately obvious as a competitor.

Examples

%20(3)%20(2).jpg)