Intelligence Fusion's EIS investment opportunity is overfunding

![Intelligence-Fusion-Overfunding-300817-LinkedIn].jpg](https://www.growthcapitalventures.co.uk/hubfs/Imported_Blog_Media/Intelligence-Fusion-Overfunding-300817-LinkedIn%5D.jpg)

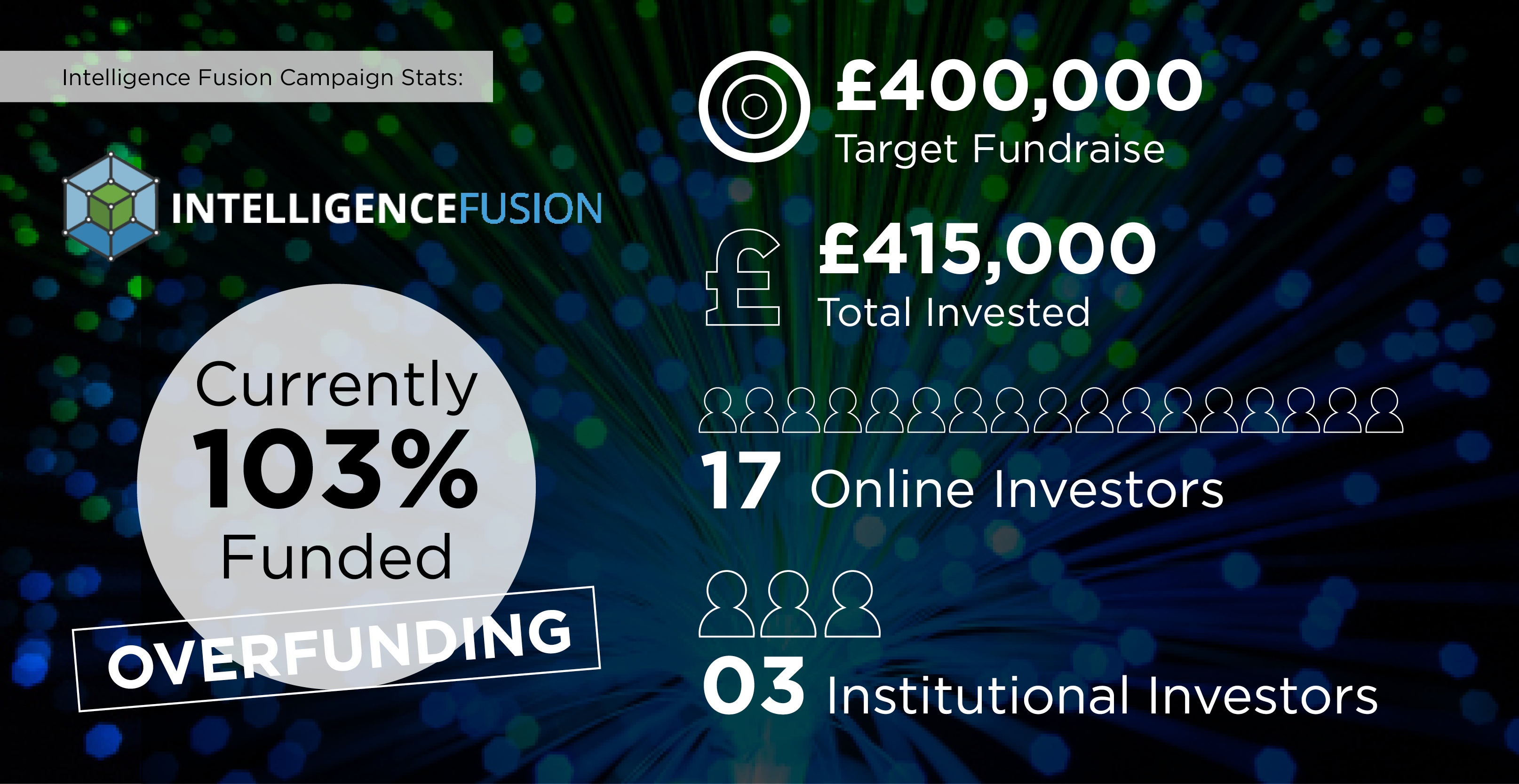

We’re delighted to announce the Intelligence Fusion EIS eligible investment opportunity has exceeded its funding target and is now overfunding!

Aiming to initially raise £400,000 in return for 33% equity, the investment opportunity is currently invested to £415,400, putting their funding percentage at 103%.

UPDATE (30/08/17): Intelligence Fusion is now overfunding by £16,400!

What does overfunding mean?

In essence, overfunding is exactly what the word suggests - the campaign has exceeded its funding target, either due to investors increasing their pledged amount, or more commonly, additional investors taking up the chance to get involved.

Not all investment opportunities go into an overfunding stage, and even when there is potential for it to happen, the company who is raising the investment doesn't have to accept the additional investment.

Being EIS eligible often makes the investment more appealing

Whilst Intelligence Fusion are doing some brilliant things as a company (you can read more about them on their website, and keep up-to-date with them on Twitter), from an investor's point of view, the most attractive aspect is arguably the fact the opportunity is eligible under the Enterprise Investment Scheme (EIS).

Being EIS eligible, any investment in Intelligence Fusion means you can receive 30% income tax relief back on your investment.

This makes the actual cost of a £100 investment just £70 - multiply this to an investment of £10,000 for example, and it becomes clear how much money can be saved in income tax by investing.

Can you still invest in Intelligence Fusion?

In a nutshell, it is still possible at this stage to invest in Intelligence Fusion, but space is extremely limited.

We are currently speaking to a number of investors about further investment into the Intelligence Fusion opportunity. As such, if you are interested in investing, please get in touch as soon as possible.

What are Intelligence Fusion looking to do with their investment?

The primary reason for raising investment is to allow Intelligence Fusion to build on the brilliant foundations they have built. They're a live, active and operating business, with some amazing clients and projects.

They have clearly shown there is a considerable demand for the situational awareness offering they provide, and the £415,500 raised will directly help to support their ambitious growth plans - plans that will help to further cement them as the leading player in their industry.

With more tax efficient investment opportunities coming on the platform all the time, head over to our investments page for the latest information on all of our live investment opportunities.

%20(3)%20(2).jpg)